What is an FTZ and when does it make sense?

A U.S. foreign-trade zone (FTZ) is best described as a geographical area declared to be outside the normal customs territory of the United States.

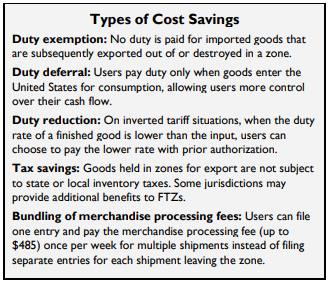

The FTZ Program offers zone users a variety of cost savings including duty exemption, duty deferral, duty reduction, tax savings, and bundling of merchandise processing fees. There may also benefit from improved logistic efficiencies, such as direct delivery of merchandise into FTZs and ease of transfers between zones. Those that will benefit most from FTZs are those that deal with high-volume importing activities.

B.I.G. Logistics offers Foreign Trade Zone services through our partners at Alliance Operating Services. AOS works with companies across the country to set up and manage their foreign trade zone programs. B.I.G. Logistics and AOS have general-purpose zone warehousing available in the DFW area.

With the submission of a brief electronic form, we can tell you exactly what your company would have saved had you been in an FTZ for the last 12 months! We can also work with you to forecast your savings for the future!

To learn more about FTZ’s and to help determine whether or not this process can financially benefit your company, contact our FTZ management team today.